IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

Eligible Expenses - American Benefits Group

fsa-claim-form by Mattress Firm Benefits - Issuu

2024 COLAs - Health FSA, Qualified Transportation and More

HSA Help Center

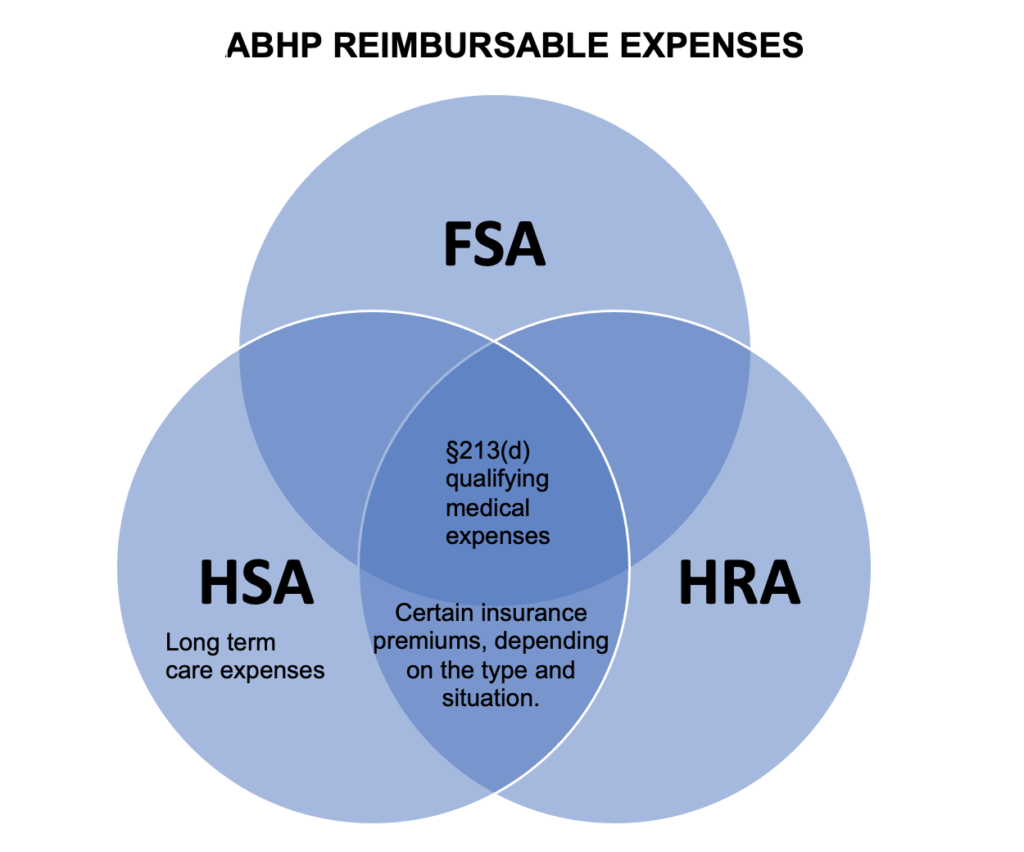

Issue Brief: Common Questions on Reimbursable Expenses - Lyons

IRS Answers FAQs On Medical Costs Paid Under HSA, FSA, And HRA Plans

Reproductive Healthcare Issues for Employers Series, Part I: May

IRS Guidance on How Health FSA Carryover Affects Eligibility for

Medical Expenses: What is Deductible and Why They Are So

IRS FAQs Address FSA/HSA/HRA Reimbursements for Nutrition