HSA Planning When Both Spouses Have High-Deductible Health Plans

HSA Planning When Both Spouses Have High-Deductible Health Plans

Financial advisors can help couples navigate the various rules around contributing to and withdrawing from HSA plans when both spouses have high-deductible plans.

Tips for increasing the benefits and tax breaks of HSAs

Ask the Benefits Expert: High Deductible Health Plans - Tandem HR

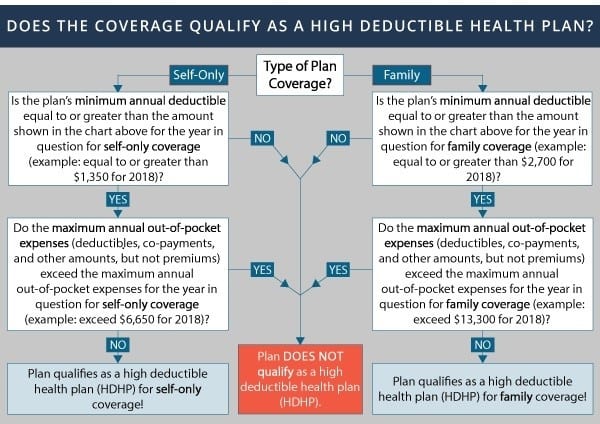

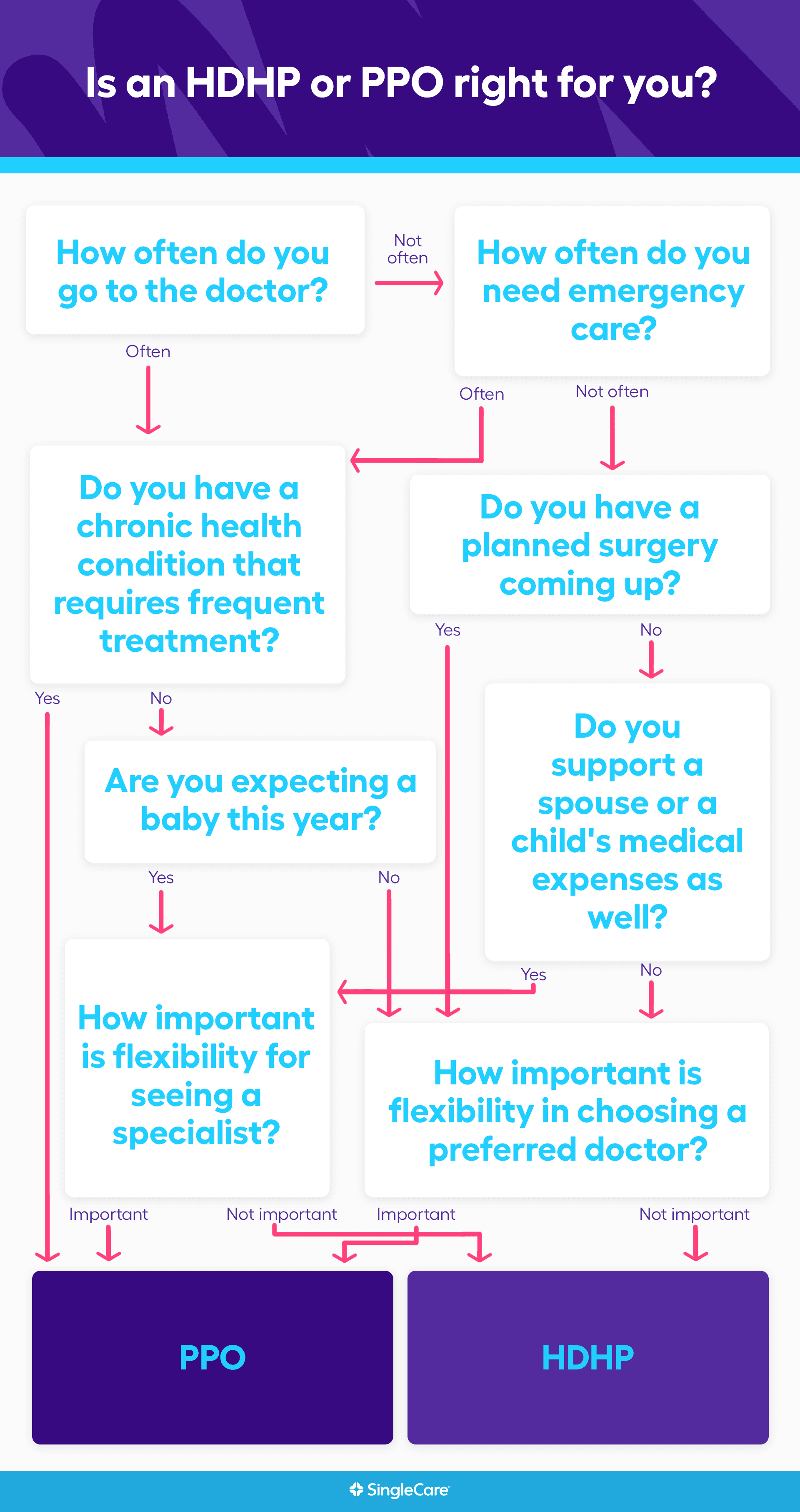

High Deductible Health Plan (HDHP) - Benefits, HSA, vs PPO

Health Savings Accounts Fill Multiple Tax Needs - Lewis & Knopf

Health Savings Account (HSA) Contribution Limits for Spouses

HSA Planning When Both Spouses Have High-Deductible Health Plans

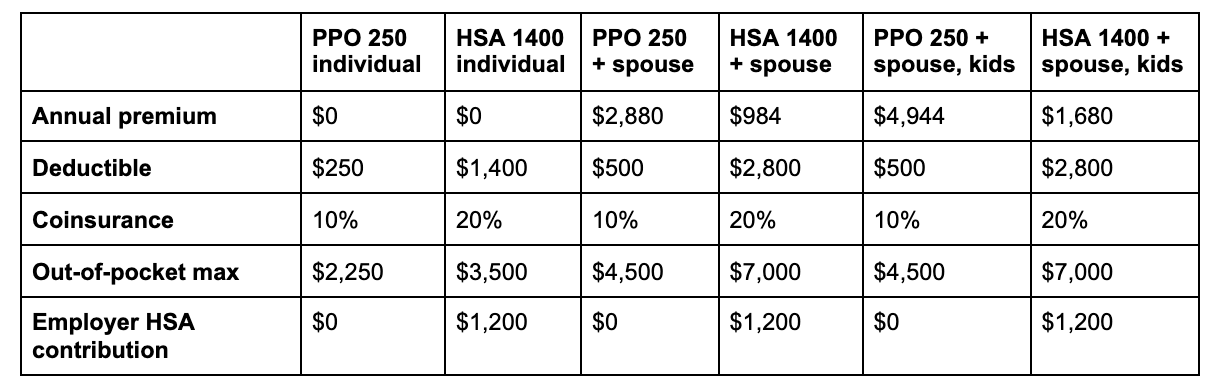

HDHP vs. PPO: What's the difference?.

How to Make Your HSA-qualified HDHP Strategy a Success

Products - Data Briefs - Number 317 - August 2018

Retirement Tax Services HSA: Tax-Advantaged Savings Accounts

HDHP vs. PPO: What You Should Know ❘ Wealthfront

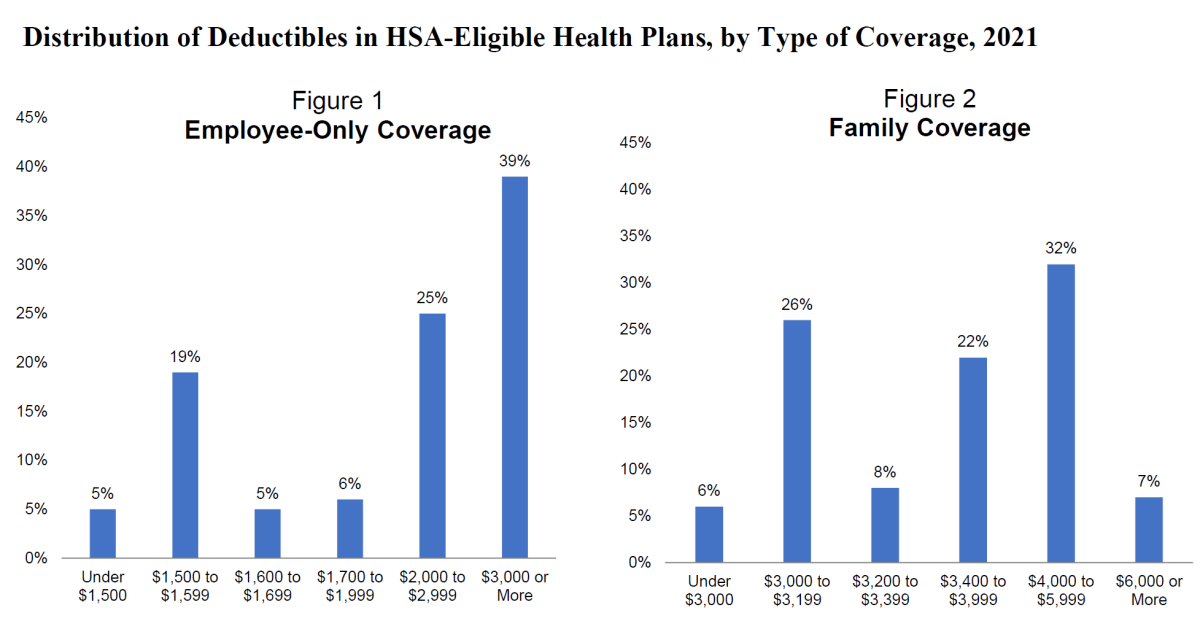

HSA-Eligible Health Plan Deductibles to Increase in 2024