IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

IRS Code Section 213(d) FSA Eligible Medical Expenses Deductible

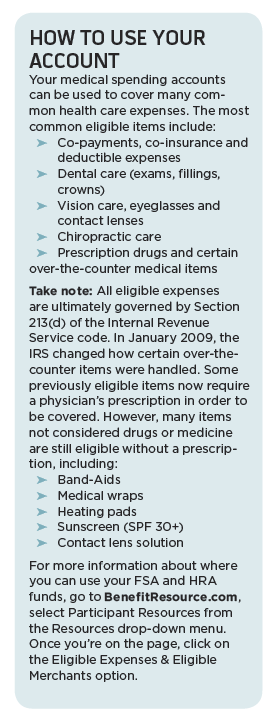

The FYI on your FSA and HRA

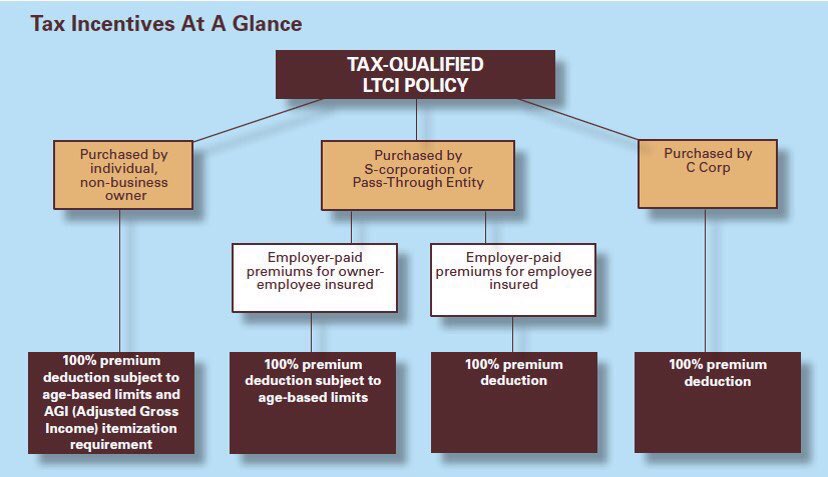

NextGen Long Term Care Planning

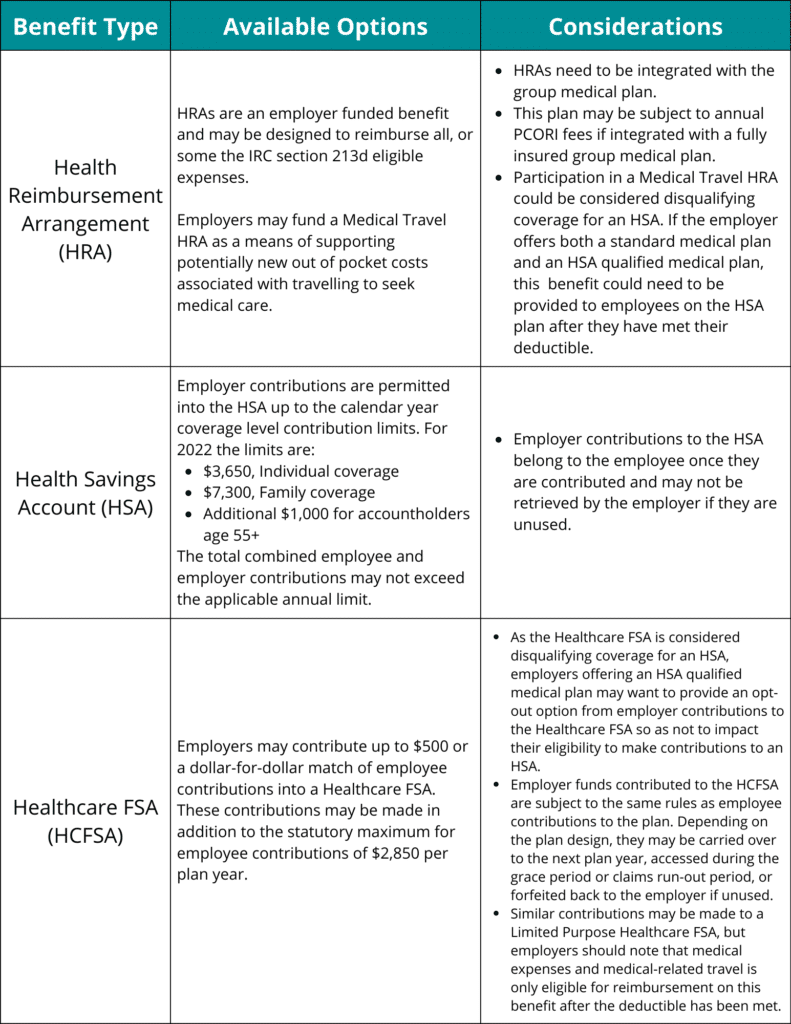

Medical Travel Benefits for Employees and What Employers Need to

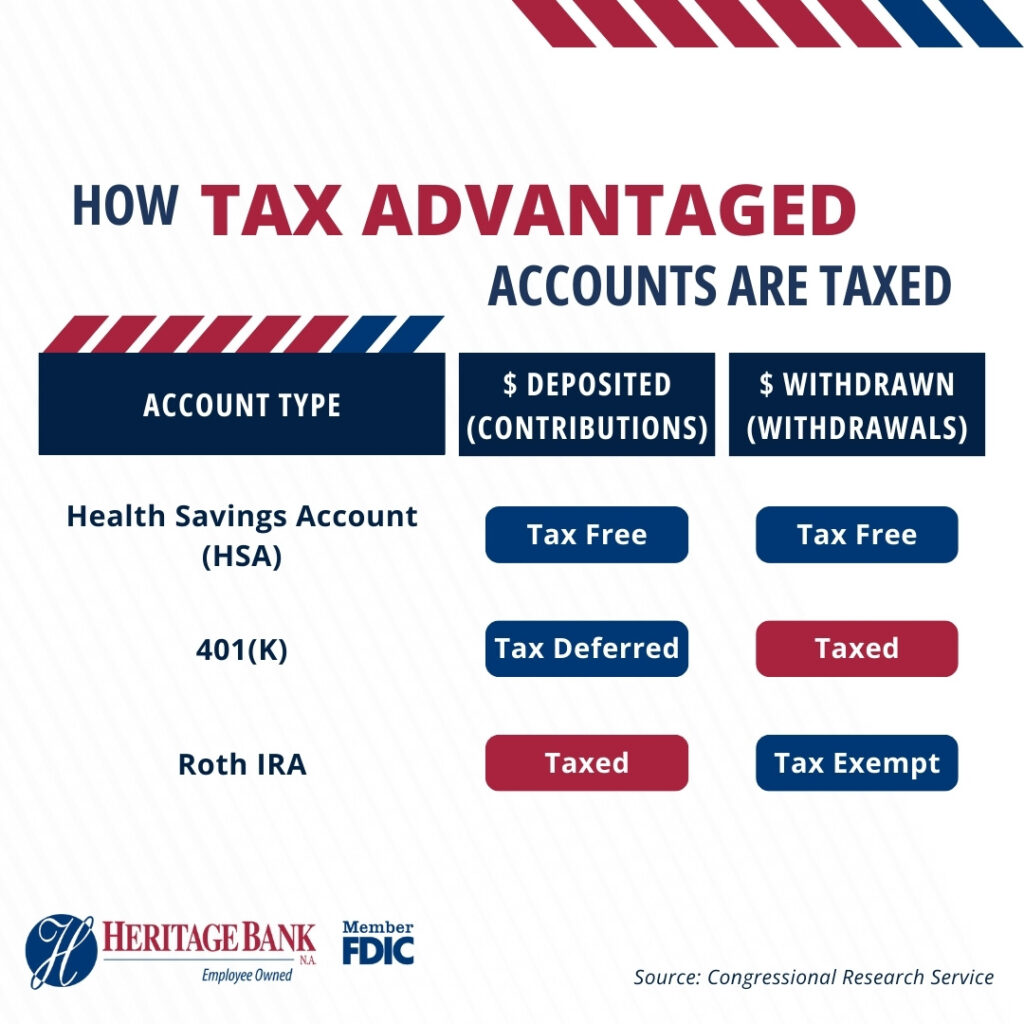

Everything You Need to Know About a Health Savings Account (HSA

IRS Guidance on How Health FSA Carryover Affects Eligibility for

Tax-Advantaged Accounts for Health Care Expenses: Side-by-Side

IRS Says Cost of COVID-19 PPE Qualifies as Medical Expense

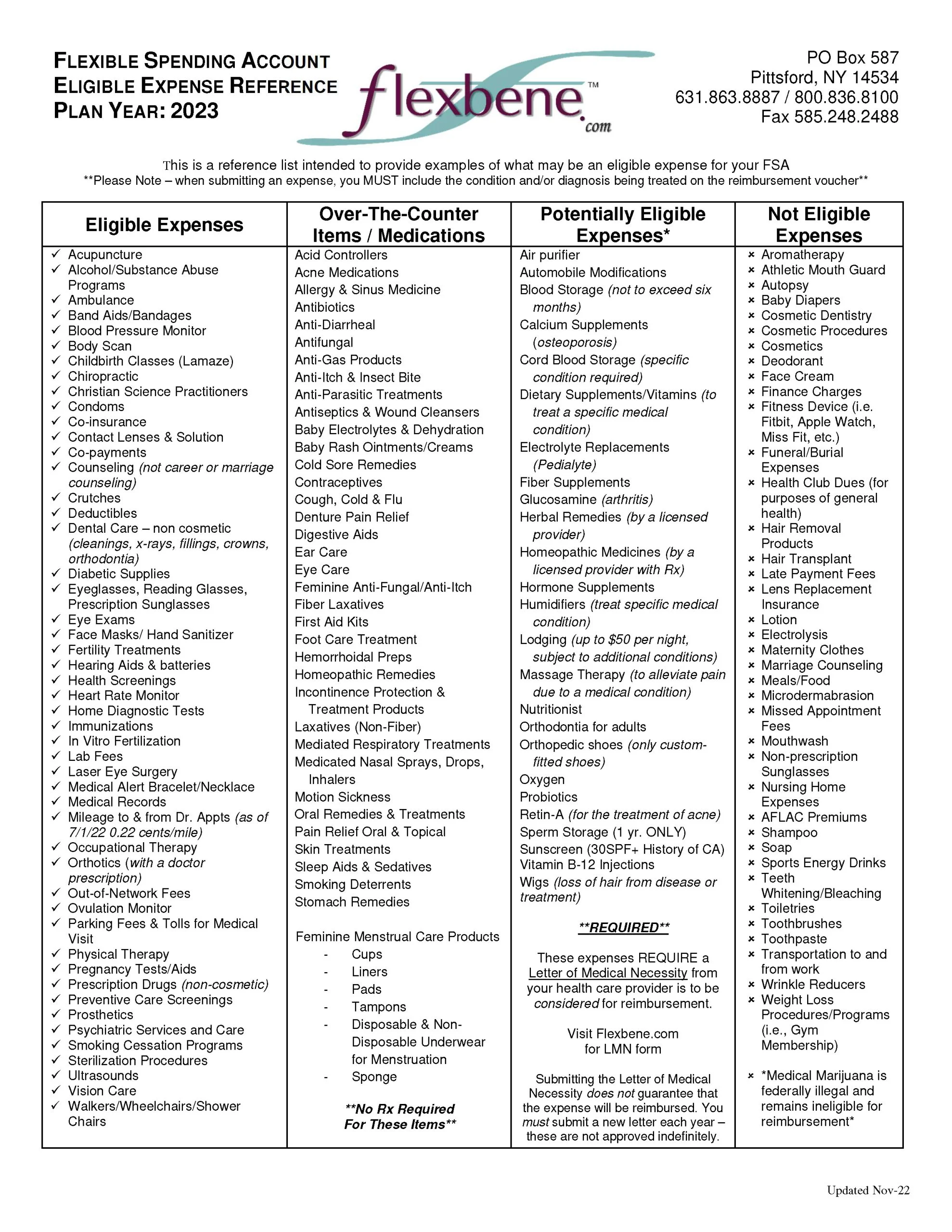

FSA Eligible Expense List - Flexbene

What Medical Expenses Qualify as Tax Deductible Under Section 213

Personal Spending Accounts

Understanding 213-D Reimbursements or Health Wallet

Tax Implications (and Rewards) of Grandparents Taking Care of