Office Supplies and Office Expenses on Your Business Taxes

:max_bytes(150000):strip_icc()/GettyImages-137552576-1--5754396c3df78c9b46367699.jpg)

Office Supplies and Office Expenses on Your Business Taxes

Deducting office supplies and office expenses, the new simpler IRS rule for expensing rather than depreciating, and where to put on your tax return.

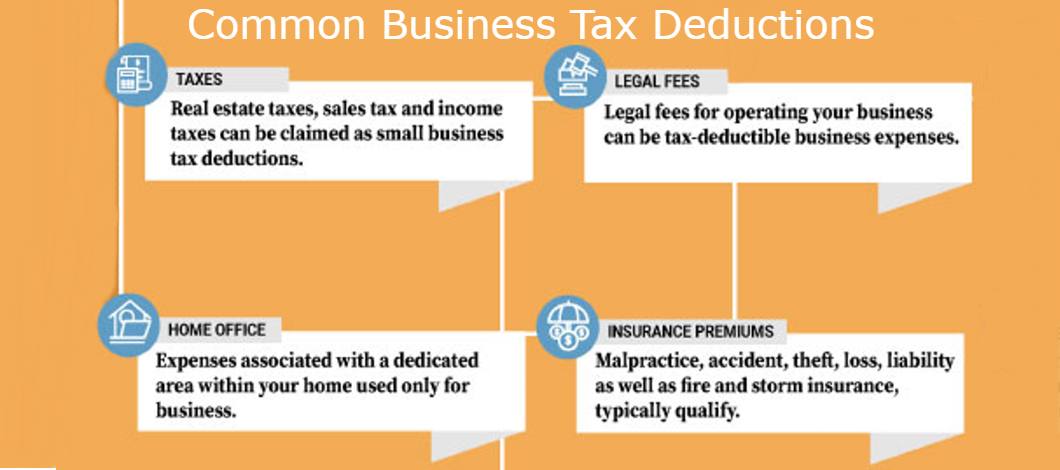

What Are Business Tax Write Offs & How Do They Work

22 Small Business Tax Write Offs to Maximize Your Return in 2023

Small Business Tax Deductions: 27 Common Ones to Write Off

:max_bytes(150000):strip_icc()/expense.asp-final-945ea7ad4a0c4eafb0dcf268e97756fc.jpg)

Expense: Definition, Types, and How Expenses Are Recorded

20 Small Business Tax Deductions to Know: Free 2022 Checklist

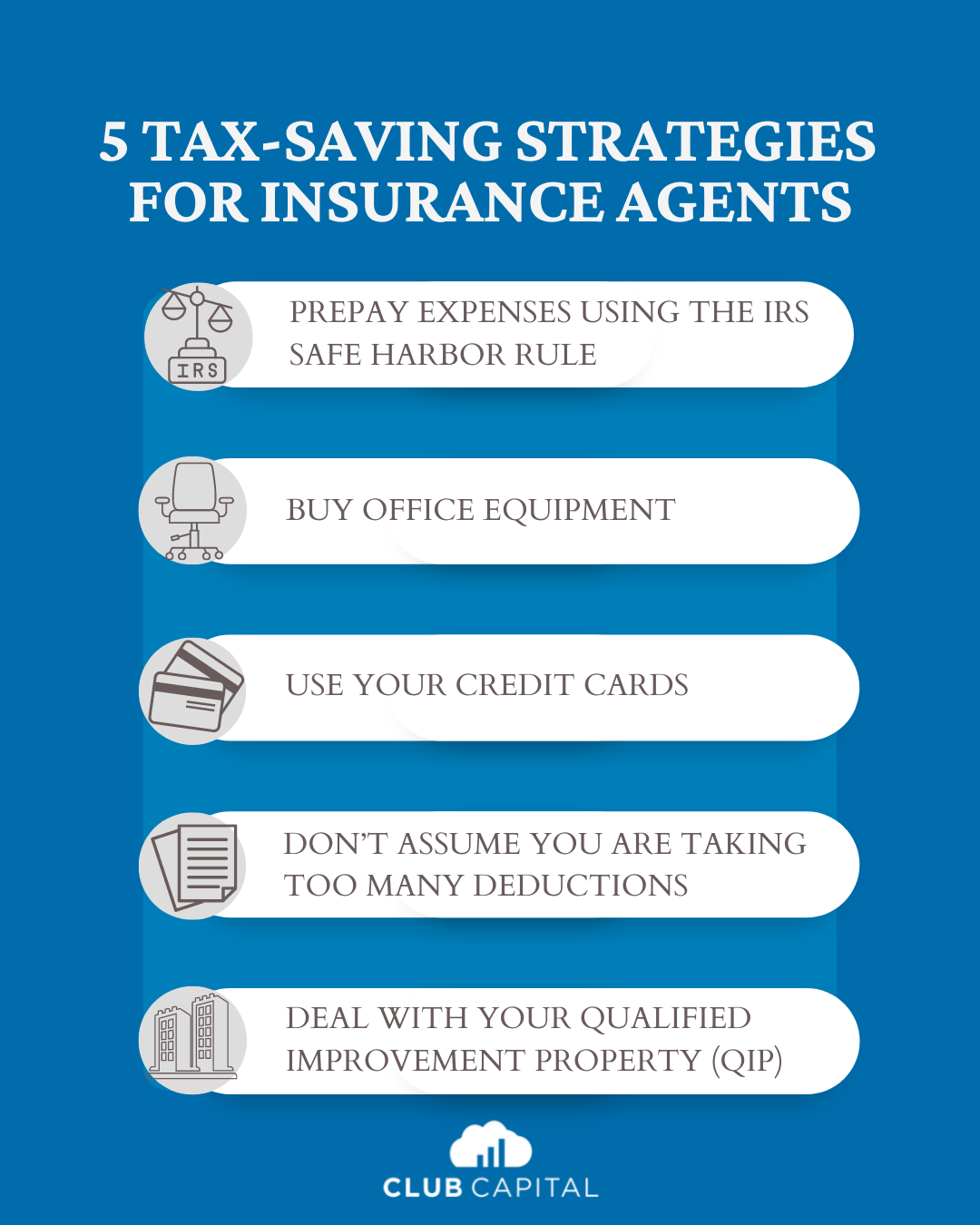

5 Powerful Tax Deduction Tips Every Insurance Agency Owner Must Know

Are LLC startup expenses tax deductible?

:max_bytes(150000):strip_icc()/a-checklist-for-setting-up-your-home-office-2951767-final-c6bf30917fa54a40a1491b14f845ece6.png)

17 Items You Need to Set up an Efficient Home Office

Write-Off Week™: Last chance to write off biz expenses w/ best

31 Tax Deductions for Shop Owners in 2023

Business Expenses: Here Are the Most Common Costs

IRS Section 179 and Eligible Property: What to Know in 2022

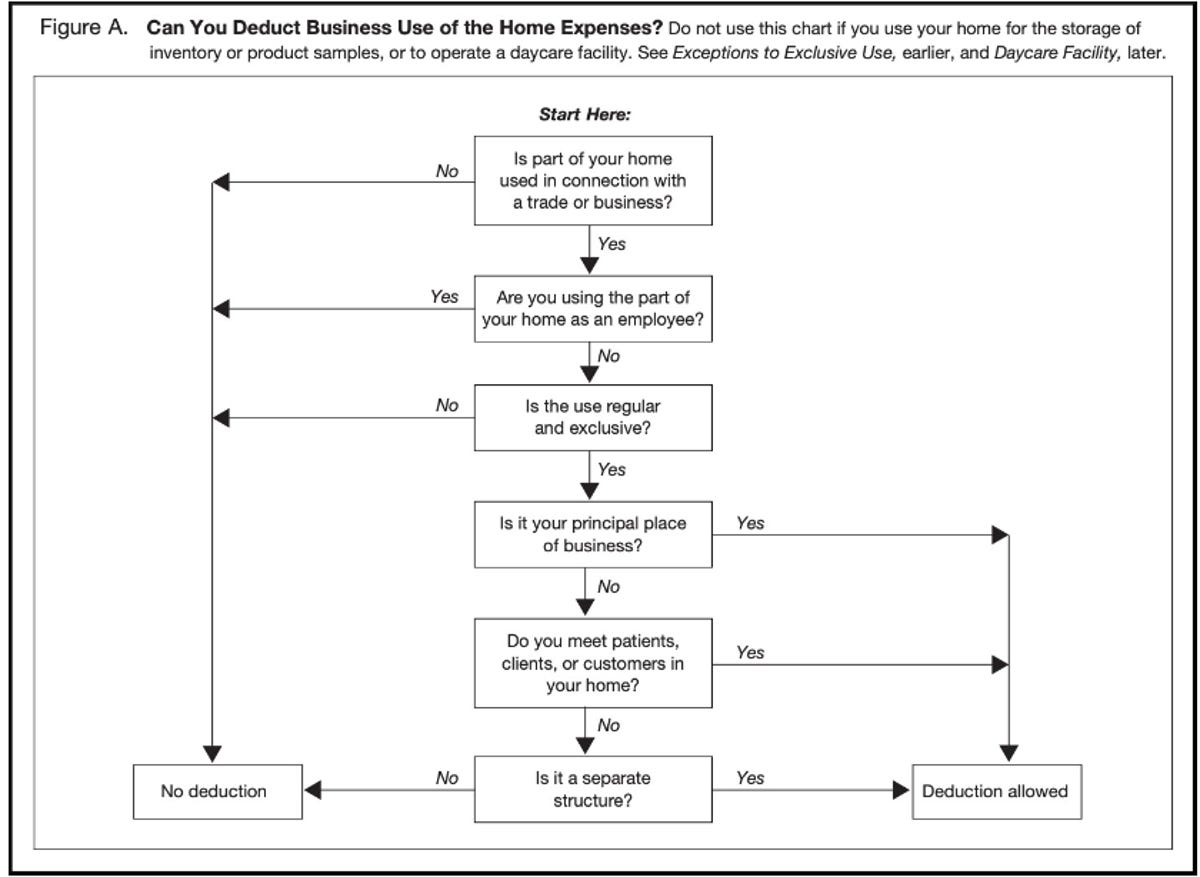

Are Home Office Supplies Tax Deductible?

Here Are the Work Expenses You Can Deduct on Your Tax Return This